Have you ever wondered if the tips you earn or give are truly tax-free? The Big Beautiful Bill has sparked a lot of questions, especially about whether there’s no tax on tips.

This topic directly affects your wallet and your peace of mind. Understanding the truth behind this can save you money and stress. Keep reading, because what you learn here could change how you handle tips forever.

Credit: fridayfirm.com

Big Beautiful Bill Basics

The Big Beautiful Bill introduces important changes in tax rules, especially about tips. It aims to clarify how tips are taxed and who benefits from these changes. Understanding the basics helps workers and employers prepare for what lies ahead.

Key Provisions

- The bill removes tax on tips received by workers.

- It ensures tips are not counted as taxable income.

- Employers must report tips but not tax them.

- It promotes transparency in tip reporting.

- Workers keep the full amount of their tips.

- The bill sets clear guidelines for tip handling.

Impact On Workers

Workers receive more take-home pay without tip taxes. This can improve their financial stability and job satisfaction. It encourages honesty in reporting tips. Workers no longer fear losing money to taxes on their earned tips. The bill supports fair treatment for tipped employees.

Credit: www.vedderprice.com

Tax Rules For Tips

Understanding the tax rules for tips can be confusing, especially when you hear different stories about what’s taxable and what isn’t. Tips are a key part of income for many workers, but the way they are taxed isn’t always clear. Let’s break down how tips are treated under current tax laws and address some common misconceptions that might be holding you back from managing your finances properly.

Current Tax Treatment

Tips are considered taxable income by the IRS. Whether you receive cash tips, tips added to a credit card, or tips shared from coworkers, you must report them. This means you should include all your tips when you file your tax return.

If you earn $20 or more in tips in a month while working for an employer, you are required to report those tips to your employer. Your employer then uses this information to withhold the proper taxes from your paycheck. This process helps ensure your tax payments are accurate throughout the year.

Many people don’t realize that even tips received directly from customers, like cash tips, are taxable. The IRS expects you to keep a daily log of all tips received to report the right amounts. Not reporting all your tips can lead to penalties and interest, so keeping track is crucial.

Common Misconceptions

One big myth is that tips are not taxed or that only wages are taxable income. In reality, the IRS treats tips as income just like your hourly pay. Ignoring tip income won’t make it disappear from the taxman’s view.

Some believe that the Big Beautiful Bill or other recent legislation has created exemptions for tipping income. But no current law eliminates tax obligations on tips. If you think you don’t owe taxes on tips, ask yourself: how would you explain this to the IRS during an audit?

Another misconception is that only reported tips are taxable. In fact, the IRS expects all tips to be reported, whether shared with your employer or kept off the books. Failing to report can trigger audits or tax penalties, which can be costly and stressful.

Have you ever wondered why some coworkers report tips diligently while others don’t? This difference can affect your paycheck, tax refunds, and even Social Security benefits later. Taking control of your tip reporting can put you ahead financially and keep you compliant with tax rules.

No Tax On Tips Explained

Understanding the tax rules on tips is important for many workers. The Big Beautiful Bill introduces a new rule about no tax on tips. This section explains what that means in simple terms. It helps readers know when tips are tax-free and when they are not.

What The Bill Says

The bill states that certain tips are not subject to federal income tax. This means workers keep the full amount of these tips. The rule applies to direct tips given by customers to workers. It aims to ease the financial burden on tipped employees.

Employers do not have to report these tips as income for tax purposes. The bill intends to support workers in service industries. It clarifies that only specific tips qualify for this tax exemption.

Exceptions And Limitations

Not all tips are free from tax under this bill. Tips shared with other employees may still be taxable. Tips included in credit card payments must be reported as income. Employers must continue to track and report these tips properly.

The no-tax rule does not apply to large tip amounts above a certain limit. Workers must still pay Social Security and Medicare taxes on tips. The bill focuses only on federal income tax relief for tips.

- Shared tips among staff remain taxable

- Credit card tips are reported as income

- Tips over a set amount are taxed

- Social Security and Medicare taxes still apply

Effects On Employees

The “No Tax on Tips” clause in the Big Beautiful Bill brings significant changes for employees. It affects how they earn and report their income. Understanding these effects helps workers prepare better.

Income Changes

Employees may see a rise in their take-home pay. Since tips are not taxed, workers keep more of their earnings. This can improve financial stability for many.

However, some may experience shifts in paycheck amounts. The overall income might change depending on how tips are handled by employers. Clear communication is key to avoid confusion.

Reporting Responsibilities

Workers still need to report tips accurately. Even without tax on tips, employers require proper records for payroll. Honest reporting ensures compliance with company policies.

Employees should keep track of daily tips. Using simple logs or apps can help maintain accuracy. This protects workers from disputes or misunderstandings about pay.

Employer Obligations

Understanding your employer obligations under the “No Tax on Tips” provision in the Big Beautiful Bill is crucial for staying compliant and avoiding penalties. These rules aren’t just about withholding taxes; they also cover how you track and report tips. You might think it’s just paperwork, but managing these responsibilities well can protect your business and support your employees.

Withholding Requirements

You must withhold taxes on reported tips just like regular wages. This includes Social Security, Medicare, and federal income tax. If an employee reports tips, you need to adjust their withholding accordingly.

What if tips are underreported? Employers are responsible for withholding taxes on unreported tips if they know or have reason to believe tips were received. This means you can’t ignore suspicious discrepancies in reported income.

Think about how withholding affects your payroll system. Accurate withholding helps employees avoid surprises during tax season and keeps your business in good standing with tax authorities.

Record-keeping Practices

Keeping detailed records of tips is a must. You should track daily tip reports from employees and maintain these records for at least four years. This helps during audits and ensures transparency.

Using a clear and simple system for tip reporting makes a big difference. Whether it’s a digital app or a paper log, consistency is key. This way, employees feel confident reporting their tips, and you have clear documentation.

Have you considered how easy it is for errors to happen without proper records? Mistakes can lead to audits or fines, which are much harder to deal with than setting up a solid record-keeping process from the start.

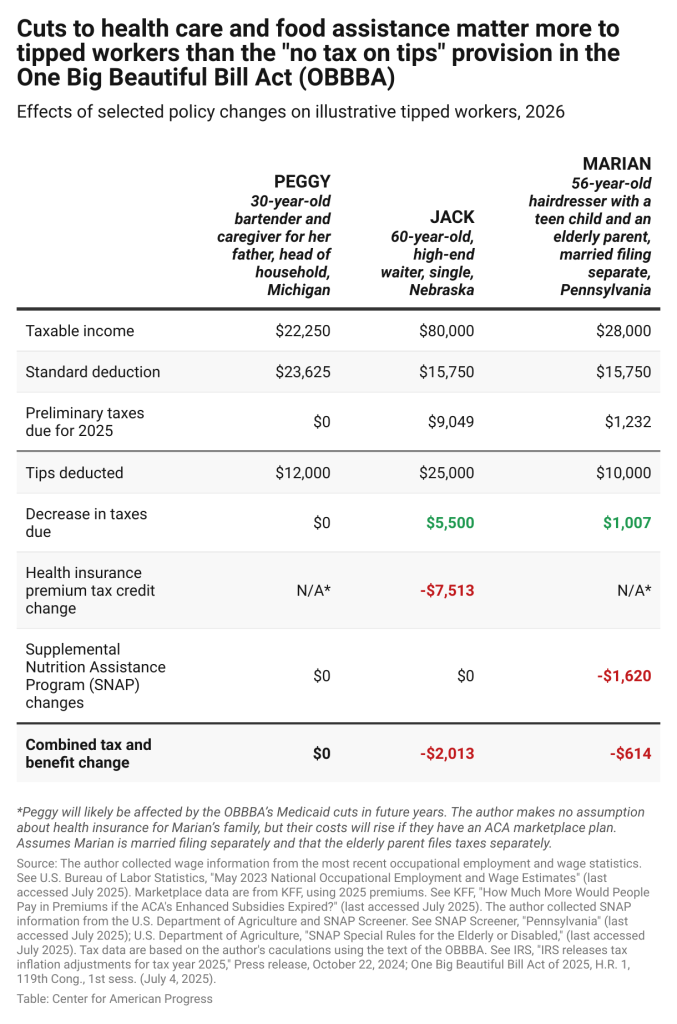

Credit: www.americanprogress.org

Potential Benefits And Drawbacks

The idea of no tax on tips in the Big Beautiful Bill sparks a lot of debate. It brings some clear advantages but also raises concerns. Understanding these can help you see how this change might affect you or your business.

For Workers

One big benefit for workers is that they get to keep more of their hard-earned tips. Without taxes eating into their extra income, their take-home pay could increase significantly.

However, there’s a downside. If tips aren’t taxed, it might affect the way benefits like Social Security or unemployment are calculated since these rely on reported income. This could mean lower future benefits for some workers.

Have you ever thought about how a change like this might impact your financial security in the long run? It’s important to weigh immediate gains against possible future losses.

For Businesses

Businesses could see administrative ease since they won’t have to track and report tip income for tax purposes. This could lower accounting costs and simplify payroll processes.

On the flip side, some businesses might struggle with transparency and fairness. Without tax reporting, it might be harder to ensure tips are shared properly among staff, which could lead to disputes.

Also, could this shift affect how customers perceive tipping? If tips aren’t taxed, will patrons tip more generously or less? These questions matter for businesses relying on customer gratuities.

Comparisons With Previous Laws

Understanding how the new bill treats tips compared to older laws helps clarify its impact. Changes in tax rules affect both workers and businesses. Comparing the tax treatment before and after the bill shows what has shifted and what stayed the same.

Tax Treatment Before The Bill

Previously, tips were considered taxable income. Workers had to report all cash and credit card tips to the IRS. Employers were responsible for withholding taxes on reported tips. This system aimed to ensure tax compliance but created confusion for some employees.

Many workers found it hard to track and report all tips accurately. Employers sometimes faced challenges collecting and reporting tip income. The old rules made tax filing more complex for everyone involved.

Differences And Similarities

- The new bill removes tax on tips under certain conditions.

- Reporting requirements remain for tips above specific limits.

- Employers still need to track tips but with less burden.

- Both old and new laws aim to prevent tax evasion.

- Workers continue to receive tips as part of their income.

The bill simplifies some tax rules but keeps key reporting elements. It offers relief without eliminating oversight. Understanding these points helps workers and employers adjust to the new system.

Frequently Asked Questions

Is There Really No Tax On Tips In The Big Beautiful Bill?

The Big Beautiful Bill does not exempt tips from taxes. Tips are still considered taxable income by the IRS and must be reported.

How Are Tips Taxed Under The Big Beautiful Bill?

Tips are taxed as regular income, subject to federal and state income taxes. The bill does not change tip tax rules.

Do Employees Need To Report Tips With The Big Beautiful Bill?

Yes, employees must report all tips to their employer. Accurate reporting ensures proper tax withholding and compliance with the law.

Does The Big Beautiful Bill Affect Tip Pooling Or Sharing?

The bill does not modify tip pooling or sharing rules. Employers and employees must follow existing tip distribution regulations.

Conclusion

The Big Beautiful Bill brings clarity on tax rules for tips. Understanding these changes is crucial for workers. Tips are vital income for many. Knowing they aren’t taxed eases financial stress. This policy can boost morale in the service industry.

Workers may feel more secure. Employers can also benefit from happier staff. It’s a positive step for everyone involved. Staying informed helps you navigate financial landscapes better. Always check for updates on tax policies. It keeps you ahead and prepared.

This bill offers hope for fairer financial treatment. A small step, but significant for many.